|

|

|

| Critical

Illness Insurance |

|

|

|

| Critical

Illness |

|

|

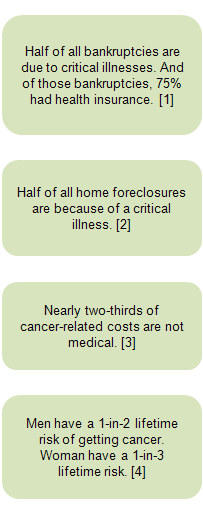

Critical Illness insurance can help relieve the financial impact of

a sudden, life-threatening event by helping to pay the direct and

indirect costs of the illness. The policy provides a lump sum cash

benefit upon the first diagnosis of a covered critical illness after

the policy effective date. Covered critical illnesses are limited

to the specific definitions found in the policy. Covered illnesses

include: |

|

| Heart

Attack |

Permanent

paralysis |

| Stroke |

Major

organ transplant surgery |

| Cancer |

End-stage

renal (kidney) failure |

| Burns |

Coronary

bypass surgery |

|

|

| Critical

Illness insurance does not require a specific expense for payout.

It is intended to help cover some of the expenses not covered by medical

insurance, such as experimental treatments, out-of-pocket deductibles

and copays, child care, travel expenses, and more.

If you are diagnosed with a covered illness, this plan will pay

you an amount that depends on the illness.

Coverage is available for yourself, for yourself and your

children or for your entire family.

Limited or no medical underwriting will be required if the amount

of coverage being applied for does not exceed certain limits.

For a complete description of this benefit please follow the link

below to the product brochure.

|

|

| Who

can have this coverage? |

|

| Employee

Only, 1 Parent Family and 2 Parent family coverage was available. Please

see the product brochure. |

|

| I

already have Critical Illness insurance. Can I cancel it and keep

this policy? |

|

|

|

Before you make a decision to replace existing insurance with new

insurance you should contact your current insurance company. You should

also consider your age and any changes in your health when evaluating

a replacement policy.

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

| |

|

Top Top |

|

|

|